The cost of living crisis has hit many families hard, leaving them less money to spend on the bare essentials including energy and food.

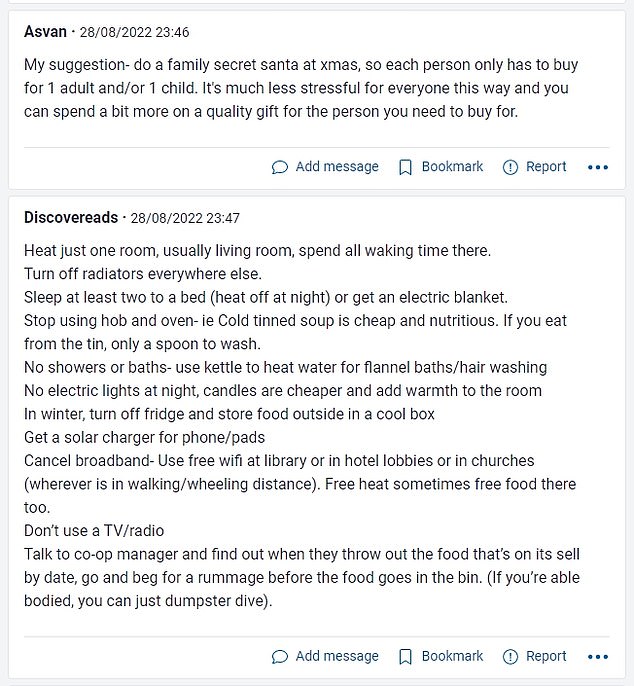

In an informative thread on UK parenting forum Mumsnet, parents shared their practical tips for cutting down on costs on daily essentials.

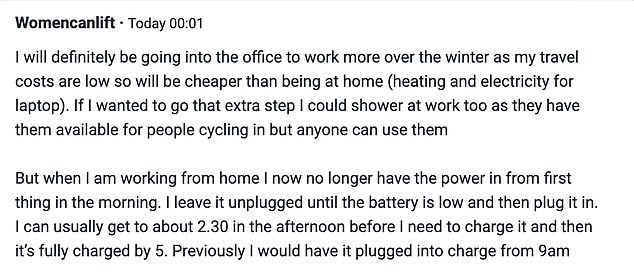

The discussion was kickstarted when a woman revealed she will consider charging electrical devices in the office if her energy bills get too high, and may fill up at thermos of boiling water at work to bring home.

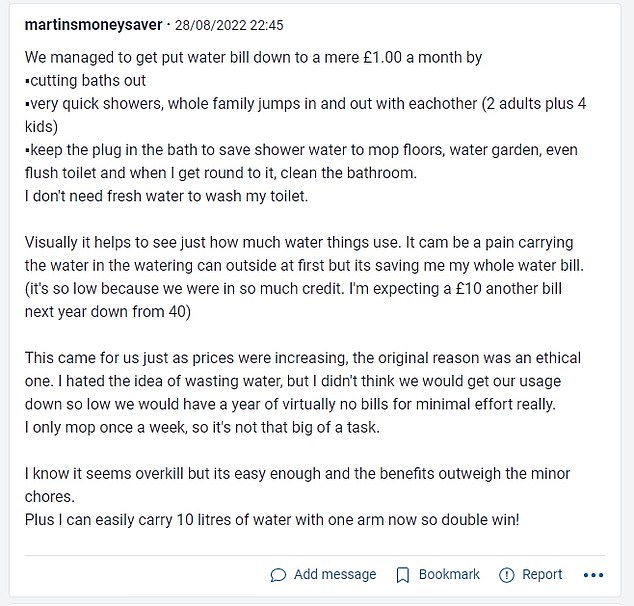

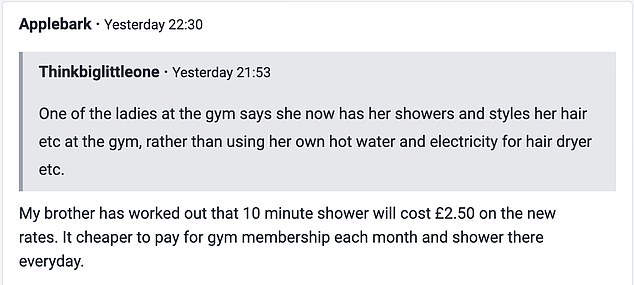

Among the tips they shared were showering at the gym, making sure you check the price-per-kilo of loose items like fruit and veg, and turning off electrical items, instead of having them on ‘standby’.

As people are increasingly struggling with money amid the cost of living crisis, a women has asked others for their cash saving tips on Mumsnet (stock image)

According to the post, the Mumsnetter is planning to use electricity at work and bulk food in bulk as fuel prices increase

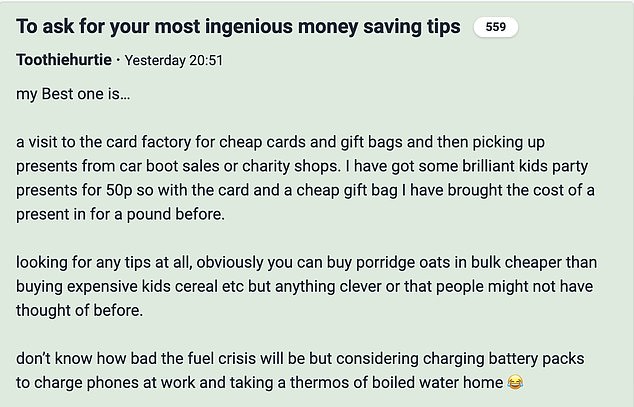

The original poster wrote: ‘Best one is… a visit to the card factory for cheap cards and gift bags and then picking up presents from car boot sales or charity shops.

‘I have got some brilliant kids party presents for 50p so with the card and a cheap gift bag I have brought the cost of a present in for a pound before.

‘Looking for any tips at all, obviously you can buy porridge oats in bulk cheaper than buying expensive kids cereal etc but anything clever or that people might not have thought of before.

‘Don’t know how bad the fuel crisis will be but considering charging battery packs to charge phones at work and taking a thermos of boiled water home.’

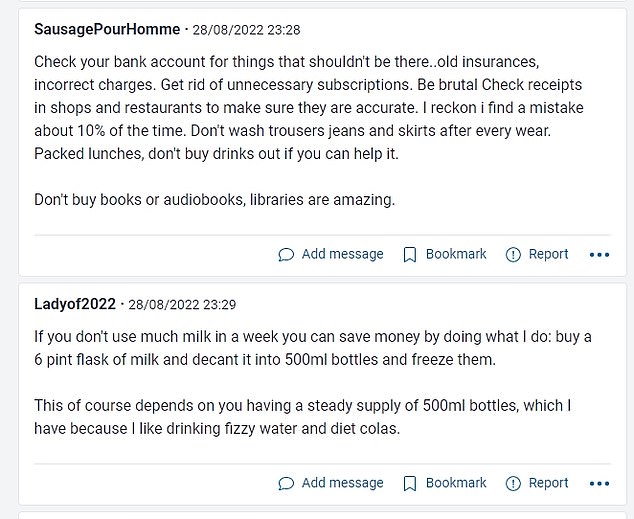

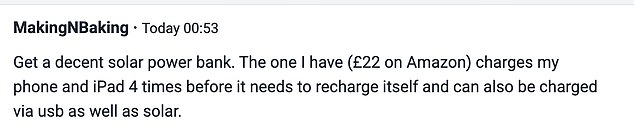

The post garnered numerous responses, with people sharing a range of tips from buying solar packs to charge their devices to paying for insurance on a 0 per cent interest credit card.

The tips shared by forum users ranged from using 0 per cent credit cards to pay for essentials like insurance to switching electrical devices off at the socket

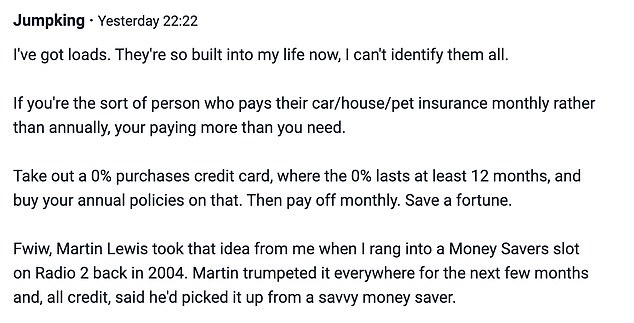

One savvy saver shared their top tip, writing: ‘If you’re the sort of person who pays their car/house/pet insurance monthly rather than annually, your paying more than you need.

‘Take out a 0% purchases credit card, where the 0% lasts at least 12 months, and buy your annual policies on that. Then pay off monthly. Save a fortune.’

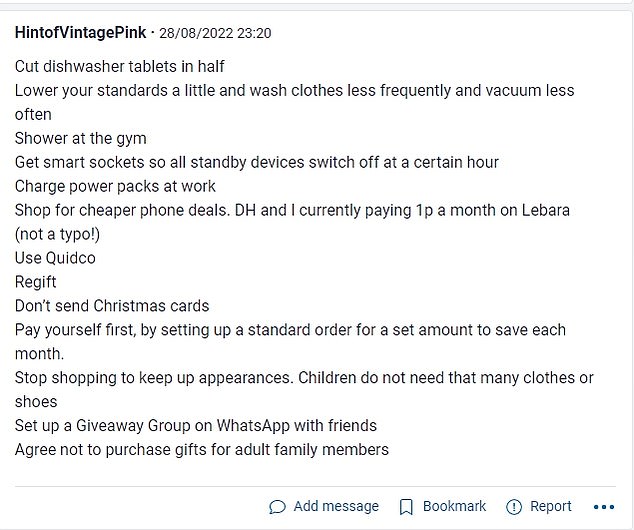

Others recommended cutting down on the amount of household product you use, with one saying: ‘Cut dishwasher tablets in half.’

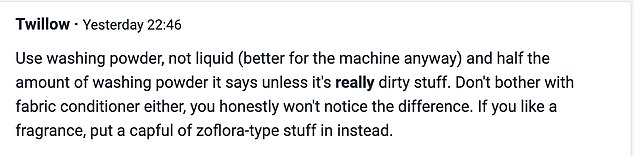

Another agreed that using less than the recommended amount of cleaning products can save cash, adding: ‘Use washing powder, not liquid (better for the machine anyway) and half the amount of washing powder it says unless it’s really dirty stuff.

‘Don’t bother with fabric conditioner either, you honestly won’t notice the difference. If you like a fragrance, put a capful of zoflora-type stuff in instead.’

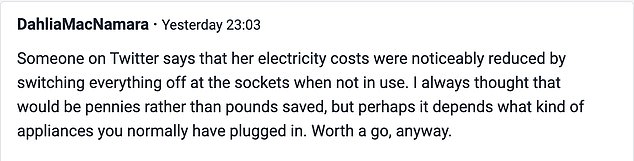

A further commentator added: ‘Someone on Twitter says that her electricity costs were noticeably reduced by switching everything off at the sockets when not in use.

‘I always thought that would be pennies rather than pounds saved, but perhaps it depends what kind of appliances you normally have plugged in. Worth a go, anyway.’

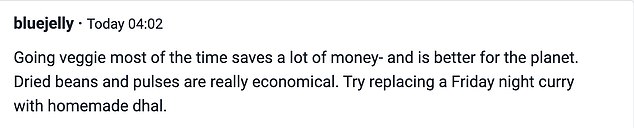

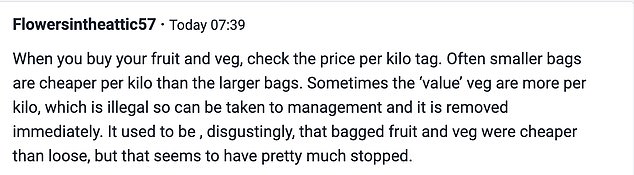

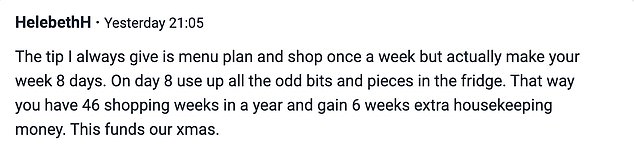

Switching out meat for beans, and being vigilant when checking the per-kilo price of fruit and veg could help save you money, according to these Mumsnetters

Others shared the money-saving tips they implement to make their food go further.

One Mumsnetter wrote: ‘Going veggie most of the time saves a lot of money- and is better for the planet.

‘Dried beans and pulses are really economical. Try replacing a Friday night curry with homemade dhal.’

Another added: ‘When you buy your fruit and veg, check the price per kilo tag. Often smaller bags are cheaper per kilo than the larger bags. Sometimes the ‘value’ veg are more per kilo, which is illegal so can be taken to management and it is removed immediately. It used to be , disgustingly, that bagged fruit and veg were cheaper than loose, but that seems to have pretty much stopped.’

And a further Mumsnetter wrote: ‘The tip I always give is menu plan and shop once a week but actually make your week 8 days. On day 8 use up all the odd bits and pieces in the fridge. That way you have 46 shopping weeks in a year and gain 6 weeks extra housekeeping money. This funds our Christmas.’

Some revealed that they will be using energy at work, or going into the office more than they need to, to make the most of the heating and save on heating their home