Saving money is really not as easy as it looks. It seems that if you do save lots of money, you’re stuck at home and can’t even go out and have fun. However, if you spend too much money on hobbies and activities, you’ll probably never save up. Finding the balance is really difficult, but perhaps this online thread will have some helpful tips and tricks.

This Redditor asked other internet users to share one budgeting tip, and many chimed in to help out. Perhaps after reading this, you will come up with the perfect plan to help you save up for whatever you’ve been dreaming of buying. And if you have your own money-saving hacks, feel free to share them in the comments.

If you’re interested in checking out more lists on this topic, click here or here.

I use the public library. I’m an avid, fast reader. It makes no sense for me to buy books because I finish them (usually) fairly quickly. I have a shelf of favorites, but other than that, I frequent the public library, whether it’s using my Kindle or getting physical copies. They’re also great for fun, free events, classes, etc.

I use the public library. I’m an avid, fast reader. It makes no sense for me to buy books because I finish them (usually) fairly quickly. I have a shelf of favorites, but other than that, I frequent the public library, whether it’s using my Kindle or getting physical copies. They’re also great for fun, free events, classes, etc.

We got an interview with the Redditor that asked the question. We asked them to share how they save money: “My money-saving tip was to do a simple meal plan and check your pantry before going shopping. One mistake would be not saving enough, and another would be not having a plan for your money.

I think saving money is extremely important, and everyone should have a basic emergency fund. There isn’t enough emphasis on saving money and financial literacy for young adults.”

I try to frame expenses, especially “wants”, in terms of time. For example: this game/clothing item/electronic device is the equivalent of x hours/days of work – is it worth it to me? Especially when I think about it from a post-tax and deduction standpoint, it helps put things in more perspective for me.

I try to frame expenses, especially “wants”, in terms of time. For example: this game/clothing item/electronic device is the equivalent of x hours/days of work – is it worth it to me? Especially when I think about it from a post-tax and deduction standpoint, it helps put things in more perspective for me.

If you’re in a shopping mood, go to a thrift shop! Sometimes I just want a new item and that itch can be scratched with a $5 skirt or a $8 dish rather than $$$ at a regular shop – bonus, there often aren’t that many items you want, so it stops you from buying up the whole shop, and secondly, items are often good quality and will last longer than getting something from target.

If you’re in a shopping mood, go to a thrift shop! Sometimes I just want a new item and that itch can be scratched with a $5 skirt or a $8 dish rather than $$$ at a regular shop – bonus, there often aren’t that many items you want, so it stops you from buying up the whole shop, and secondly, items are often good quality and will last longer than getting something from target.

They also shared where people should draw the line when it comes to saving money: “If you are miserable every day and are giving up simple pleasures like having lunch with friends to save money, then you might be too frugal. Or if saving money becomes obsessive and damages your personal relationships or mental health.”

Shop your fridge, freezer and pantry BEFORE you even contemplate grocery shopping. The meme is true “we have food at home.”

Shop your fridge, freezer and pantry BEFORE you even contemplate grocery shopping. The meme is true “we have food at home.”

I live in a small apartment that hasn’t been updated since 1970 and I drive an old car. I don’t make a ton of money and I’m not particularly spendy in other areas, but I could be spending $700 or $800 more in fixed costs easy if I rented and drove “what I could afford.”

I live in a small apartment that hasn’t been updated since 1970 and I drive an old car. I don’t make a ton of money and I’m not particularly spendy in other areas, but I could be spending $700 or $800 more in fixed costs easy if I rented and drove “what I could afford.”

A few times a year I get the bug to move into a nicer apartment, but instead I spend a few hundred bucks on a new rug or jazzy wallpaper or new sheets.

They also shared some thoughts on how much money people should put aside every month: “This depends on income, but I was taught to pay myself first by putting 10% of each paycheck into savings before spending on anything else.”

For me it would be meal planning! Pre-COVID my husband and I never planned meals. He would get lunch at the cafeteria at his work and I would either eat snacks or walk to the nearest fast food place by my office. One of us would call or text the other on the way home from work with the dreaded what’s for dinner question which meant we would hitting the store almost nightly. It also meant we ended up buying things we already had at home. When we moved two years ago I found SIX jars of dried basil! We were also going out to eat a lot.

For me it would be meal planning! Pre-COVID my husband and I never planned meals. He would get lunch at the cafeteria at his work and I would either eat snacks or walk to the nearest fast food place by my office. One of us would call or text the other on the way home from work with the dreaded what’s for dinner question which meant we would hitting the store almost nightly. It also meant we ended up buying things we already had at home. When we moved two years ago I found SIX jars of dried basil! We were also going out to eat a lot.

When the lockdowns happened going to the store every day wasn’t advised or safe so I started planning out our meals and what we could reuse for multiple meals. We would spend so much less on food when I would check what we already had first and make a list. We also stopped needing to grab takeout as much. The habit stuck and I’ll never go back to how it was before.

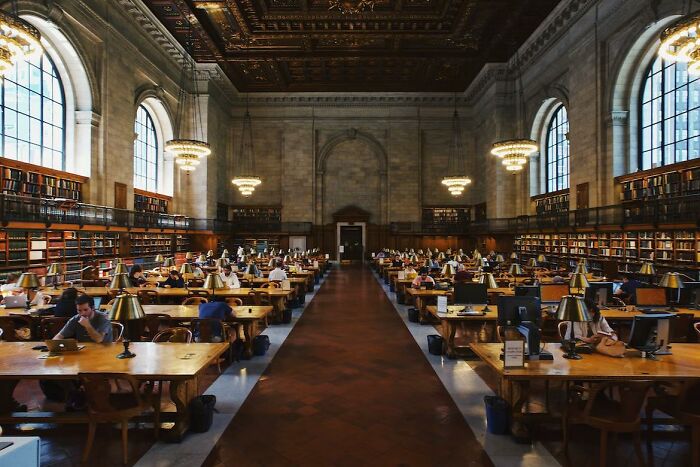

On my grocery list, I include a ‘not’ section, too, to remind me of things I commonly buy but don’t need this week (generally butter, cheese, carrots, onions, potatoes, beans, pulses, herbs, and spices). It helps stop some ‘just in case’ purchases.

On my grocery list, I include a ‘not’ section, too, to remind me of things I commonly buy but don’t need this week (generally butter, cheese, carrots, onions, potatoes, beans, pulses, herbs, and spices). It helps stop some ‘just in case’ purchases.

Pay myself first. Before any “fun” money is spent, I’m throwing $$ into my savings fund. I haven’t set it up for an automatic payment yet but I will in the next few weeks.

Pay myself first. Before any “fun” money is spent, I’m throwing $$ into my savings fund. I haven’t set it up for an automatic payment yet but I will in the next few weeks.

I generally check Marketplace and local groups before I buy things like clothes, toys, baby gear and furniture (within reason, obviously there are some things that shouldn’t be bought used). If I can find it in good condition used, I’ll get it instead of buying new. I’ve saved heaps this way, and it’s better for the environment.

I generally check Marketplace and local groups before I buy things like clothes, toys, baby gear and furniture (within reason, obviously there are some things that shouldn’t be bought used). If I can find it in good condition used, I’ll get it instead of buying new. I’ve saved heaps this way, and it’s better for the environment.

If you are planning on taking on new debt by financing a large purchase (car, house, etc.), calculate what the monthly payment would be then practice making that payment by putting that amount in a savings account each month. It gets you used to having that expense in your budget and helps you save up a down payment.

If you are planning on taking on new debt by financing a large purchase (car, house, etc.), calculate what the monthly payment would be then practice making that payment by putting that amount in a savings account each month. It gets you used to having that expense in your budget and helps you save up a down payment.

Budget realistically. If you give yourself unreasonable goals, you’re setting yourself up to fail. Base your budget off of actual previous spending and try to improve slowly but surely. Yes, “no spend November” can be a fun challenge, but it’s not sustainable.

Budget realistically. If you give yourself unreasonable goals, you’re setting yourself up to fail. Base your budget off of actual previous spending and try to improve slowly but surely. Yes, “no spend November” can be a fun challenge, but it’s not sustainable.

Use a spam email account for any purchases you make so that the marketing emails go to that account instead of the account you use for everything else. No more impulse shopping when “deals” come through in your email.

Use a spam email account for any purchases you make so that the marketing emails go to that account instead of the account you use for everything else. No more impulse shopping when “deals” come through in your email.

bought a 99 civic with 125k miles from a neighbor when I was 15 and was devastated when it died a month ago. It had 273k when it stopped working and I will not be buying a new car. I don’t need that expense, and it’s nice biking places bc I am fortunate enough to live in a pretty bike friendly city. It has also cut down on my spending bc I hate online shopping and i rarely go to stores now, same with stopping at a fast food place on my way home from work. Really the only things I spend money on now are food, rent, loans etc and then I save most of what’s left. Only way I could spend less money is if I stopped buying weed and going out with friends, BUT it is important to have things that get out of the money saving, work grindset and live a bit.

Letting things sit in my cart for a week before checking out has helped a lot. Or sending them to my “save for later” half the time I forget about them.

Letting things sit in my cart for a week before checking out has helped a lot. Or sending them to my “save for later” half the time I forget about them.

Keep track of everything you spend. From pricy to cheap. Add it all up at tte end of the month. It’s scary how much unnecessary spending goes on!

Keep track of everything you spend. From pricy to cheap. Add it all up at tte end of the month. It’s scary how much unnecessary spending goes on!

Also: money is no good if you don’t look after you health. So take care of yourself. You’re worth that trip to the therapist/gym/doctor…

Also: money is no good if you don’t look after you health. So take care of yourself. You’re worth that trip to the therapist/gym/doctor…

Use your credit cards like cash (that gives you cash back!). Don’t spend money you don’t have yet, and pay it off at least once a month.

Use your credit cards like cash (that gives you cash back!). Don’t spend money you don’t have yet, and pay it off at least once a month.

Reporting my annual mileage to my car insurance company since my annual mileage is less than half of the generic estimate they use. Savings from that add up over time!

Reporting my annual mileage to my car insurance company since my annual mileage is less than half of the generic estimate they use. Savings from that add up over time!

Leave the house less (aka make due with what you have) literally every time I leave the house I spend at least $100. Groceries, fuel, toiletries, whatever. It’s relentless, and it sucks.

Leave the house less (aka make due with what you have) literally every time I leave the house I spend at least $100. Groceries, fuel, toiletries, whatever. It’s relentless, and it sucks.

Mine would relate to food as well:

Mine would relate to food as well:

– cultivate the skill of home cooking so you enjoy what you cook as much as a mid-range restaurant meal, and learn to enjoy the process so it doesn’t feel like a chore. That way, when you’re tired through the week, you can pull something yummy out of the fridge that costs a tiny percentage of what you would pay if you ordered delivery or went out.

I was watching a TV show the other week (Gruen, in Australia) where one of the hosts said research suggests that only ten per cent of people actually enjoy cooking and both me and my husband turned to each other and said thank God we fall in that ten per cent! It saves so much money and feels financially empowering.

Always always always saving something! Even if it’s 10, 20, 50 bucks. I saved $50 out of my paychecks since I started working because something is always going to come up or is coming up. Holidays, birthdays, car repairs, etc.

Always always always saving something! Even if it’s 10, 20, 50 bucks. I saved $50 out of my paychecks since I started working because something is always going to come up or is coming up. Holidays, birthdays, car repairs, etc.

Shopping secondhand on Vinted. I’ve purchased so many new items that are in excellent condition and add a third of the price of the current collections in the stores. My last purchase was a super comfortable pair of loafers which cost me only £10 with shipping included.

Shopping secondhand on Vinted. I’ve purchased so many new items that are in excellent condition and add a third of the price of the current collections in the stores. My last purchase was a super comfortable pair of loafers which cost me only £10 with shipping included.

Plan once a year to call all your providers / services and negotiate for better deals and if necessary, be prepared to leave a service and try another for a better deal.

Plan once a year to call all your providers / services and negotiate for better deals and if necessary, be prepared to leave a service and try another for a better deal.

I have had my internet “first year” 50% off deal extended for going on 3 years now. My cell phone plan is excellent and frugal, and in October I lowered my auto insuance by $53 a month for the same coverage (and actually a little better in a few areas)

It does take a little time and effort, but when you consider how much it saves over the course of a year, it’s completely worth it.

I am also a big believer in rotating streaming services and/or sharing them with friends/familes. I have Prime, Neflix, and Crave but they only cost me $11 a month total because I share them all.

I leave my purse/phone in the car at certain stores (Michaels, Menards) so that I have to go out and get it before checking out. That 2 minutes and leaving empty handed breaks the spell and I can go back in and really edit my overflowing cart before I get in line. Weird, but it works!

I leave my purse/phone in the car at certain stores (Michaels, Menards) so that I have to go out and get it before checking out. That 2 minutes and leaving empty handed breaks the spell and I can go back in and really edit my overflowing cart before I get in line. Weird, but it works!

I’m by no means a minimalist, but I do like to think of my purchases through Marie Kondo’s “What gives you joy?” lens.

I’m by no means a minimalist, but I do like to think of my purchases through Marie Kondo’s “What gives you joy?” lens.

If it’s a purchase, however frivolous, that truly makes you happy–it is probably worth it (if you can afford it/make it worth saving for).

I was able to cut so many things (and spend more on higher quality things) when I looked at things through the “does it bring me joy” lens. Whatever those things are is going to be different from person to person, but this idea has really helped me cut back without feeling deprived.

Idk if this is my *most* important thing, but it’s certainly been an effective and important one for me.

Let’s see, I’m putting this down without looking at the others.

Let’s see, I’m putting this down without looking at the others.

Have a budget category solely dedicated to the household upkeep. Excludes bills and food, includes repairs, replacement of appliances, smaller renovations (limited to one piece of furniture, one wall, one window segment, anything bigger needs its own category) and may also include household necessities such as cleaning products, tissues, toilet paper, gloves, etc. etc. This way, you are able to separate these expenses from the food and you can also have a good view on how much you spend on these things, considering that it’s pretty much a non-negotiable category.

Minimize big ticket expenses – rent, car payment. Do without a car if you can, etc.

Note: this post originally had 57 images. It’s been shortened to the top 31 images based on user votes.