As children, one of the most critical things we are taught is to be literate. Many of us are also taught basic survival skills, such as cooking and household chores. But how many of us are taught the basics of money management and finance? These topics may seem complex in nature, but in reality, they form the foundation of our daily lives. Right from purchasing college textbooks, to paying your first rent, money is intrinsically woven into many of the things we do.

Financial literacy in young adults should not be taken for granted, even if they’re starting late. Whether you’re starting college or your first job– taking control of your finances early can set you up for major success. To add, young adults who are cognizant of their financial habits are hopefully more likely to pass them on to their future generations.

Here are tips and hacks young adults should be aware of to manage their money better.

Self-Reflect On Your Expenses

It’s easy to trigger happiness on shopping websites. Something is on sale, your debit card is already linked to your account, and voila with a simple click of a button you’ve ordered something straight to your doorstep. Yet, how many of us think how this seamless purchase fits into our larger budget? Do we consider how much we spend online versus how much we may be earning each month?

When managing your own money, it is first important to be honest with yourself. If you’re a newly working professional taking stock of your income, your expenses, and (potentially) debts is a good starting point. College students and even teenagers can compare what their expenses are versus their allowances. This will give you an idea of your spending power, the potential savings you have and, more generally, the things you can and cannot afford to do with the money you make.

Being honest with yourself is not limited to just mentally- physically writing these things down on a piece of paper to see where your money is going and coming from. Once you have reflected on your finances, you will have clarity on budgeting, which is the second step in this process.

Budget, It’s a Tale as Old as Time

To budget implies rationing out your spending power intelligently. The first step to budgeting entails setting aside money for your essentials which include food, rent, electricity and other monthly bills. Ideally, these should ideally be less than half of your monthly income for smooth sailing. But living expenses can vary per city, making it critical that you’re budgeting in relative terms.

After the essential expenses are accounted for then come the wants. Human wants can be nearly endless and it’s easy to get enamored by the latest smartphone or piece of clothing that you don’t really need. Yet at the same time, indulging in your desires can be warranted if you’ve earned it, such a holiday. How then does one prioritize their endless list of wants? One’s desires should be balanced out against their EMIs, such as education loans, along with how much they intend to save. Once these are calculated, any residual amount can be used to splurge.

The next question undoubtedly comes down to “how much should I save?”

Save For a Rainy Day

Life can be unexpected. While it’s important to not harp on that, it is equally important to ensure that you are prepared for such moments. Saving money is a step in the right direction that can help provide a cushion during an unforeseen financial crisis.

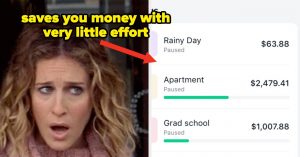

Saving money need not be just for a crisis. Many of us have dreams for a bright future- a master’s degree abroad, a first car, first home, kids, and eventually a happy retirement. But these all come with planning. By researching costs and mapping out a timeline, you will know much you need to save and invest so that you can plan.

While specific amounts can vary, it’s wise to allocate anywhere from 10%-20% of your earnings for an emergency fund. By accruing this amount over time, you will have a buffer to get back on your feet if you lose your job or if you cannot continue to work for some reason. The liquidity of your emergency fund is also of prime essence. In order use it whenever you need it, it is prudent to save money in your savings account or in an investment instrument that’s liquid.

Take a Walk Down the Investment Lane

Investments are a great method to grow your savings for young adults over the age of 18.

How then does one start their investment journey? If you’re new to the world of investments it’s wise to take a risk assessment, which can help you narrow down on a few investment vehicles that could help you earn certain for the risk you’re willing to take. Some popular asset classes include gold, fixed deposits, and equity mutual funds.

For example, as a beginner, you might have very little knowledge of the markets and therefore may decide on investing in fixed deposits and mutual funds. Mutual funds are managed by qualified expert teams. This means that someone who has made a career out of investing profitably is going to make your investment decisions.

To determine the right funds to invest in, it is important to find a platform you can trust. With the growth of fintech in India, there are now several apps to choose from. Some of these platforms can provide investment advisory services, which means they will help assess your risk and provide a recommendation for your investments.

Investing long term can help your money compound, which means the interest continues to grow. This can help you create a strong cushion for that rainy day, or, perhaps, even a master’s degree you want to pursue abroad.

Know How To Deal With Debt

There are two kinds of debts one can incur, necessary and unnecessary. With necessary debts, you’re borrowing money to buy an asset that usually provides a long-term benefit. Take education for example. With the rising costs of tuition fees, it might not be possible for you to save and invest the entire amount you need. This could result in taking an education loan, which you will be responsible for paying off after you finish your degree. In this circumstance, it’s hard to contest the long-term value of an education, which justifies you taking a loan.

Conversely, buying a new mobile phone each year and having to pay high monthly instalments or EMIs is unnecessary. While easy EMI and pay-later options have given us great convenience, that convenience tends to put most in unnecessary, avoidable debt. In your 20s, your borrowing capacity tends to be limited but it is important to ensure that you’re not getting yourself into debt by buying stuff you don’t need. Therefore, it is important to balance your debts while considering your long-term goals and budgets.

Bottom Line

As a young person, take control of your finances today. Money plays an important role in our lives and deserves sizable attention. Budgeting, saving, and accounting for your debts are disciplines that should be learned early. If done correctly, they will set you up for financial freedom.