We are heading for a cost of living crisis. Energy bills are rising, food prices are set to soar and tax hikes will soon start to bite.

The pandemic threw many of our finances up in the air. Many were forced onto furlough and saw their incomes shrink overnight; others saved a fortune as commuting and socialising became impossible in lockdown.

But now we are emerging from the virus crisis, many are seeing their expenses rise as they return to the office.

At the same time, inflation is rising. The Bank of England has warned it could hit 4 per cent by the end of the year, while supermarkets have said food prices could increase by 5 per cent.

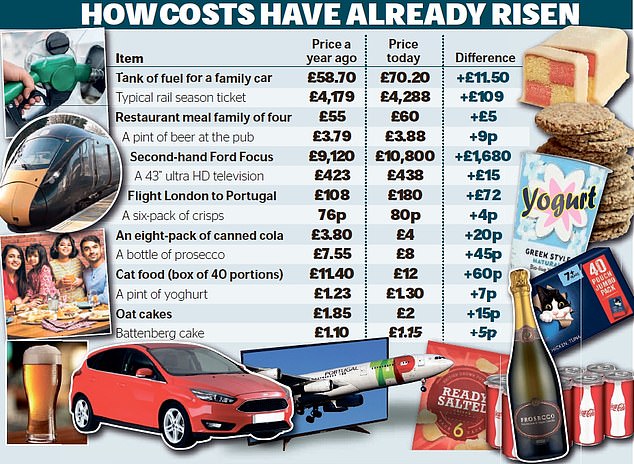

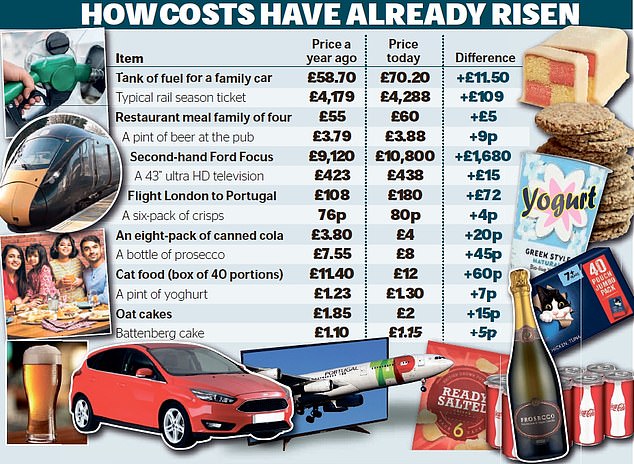

Analysis of price rises in the last year shows the cost of a second-hand car has risen more than £1,600, a tank of fuel is up more than £10 and the price of a pint of beer is creeping close to £4

A Money Mail poll today also reveals that one in two households have started making cutbacks due to concerns over the rising cost of living.

Our survey, carried out by Consumer Intelligence, found many had started to scale back spending within the last one to three months — with most fearing rising food and energy prices.

And exclusive research for the Daily Mail by the Centre for Economics and Business Research (CEBR) also yesterday revealed how inflation will cost the typical family of four an extra £1,800 by the end of this year.

Meanwhile, a retired couple can expect to see living costs rise by more than £1,100, and a lower income couple could be stung by nearly £900.

Analysis of price rises in the last year alone shows the cost of a second-hand car has risen more than £1,600, a tank of fuel is up more than £10, the price of a pint of beer is creeping close to £4 and a bottle of prosecco has risen 55p to £8.

It comes as the new month of October marked the end of the furlough salary support scheme as well as the withdrawal of an extra £20-a-week for struggling households receiving Universal Credit.

The energy price cap has now also increased, pushing up bills for more than 15 million households by an average of close to £140 a year.

And the soaring cost of wholesale gas has seen many suppliers go bust – forcing millions of customers on cheap deals onto more expensive tariffs linked to the price cap.

So, we will help you beat the cost of living crunch. Here, the country’s top personal finance experts share their tips for managing your money and making crucial savings.

Back to basics

After the pandemic disrupted our spending and saving habits, now is a good time to draw up a fresh household budget.

Our survey found that of those households cutting back, more than half were saving by not spending on luxuries such as eating and drinking out.

Three out of four said their cutbacks should be enough to keep them from struggling with money.

Laura Suter, head of personal finance at investment broker AJ Bell, says: ‘If you’re facing a fall in income or rising bills — or a toxic double whammy — then you need to get a grip on your finances and look at what you can afford.

‘It’s not a particularly pleasant job but it’s essential to avoid getting into financial strife further down the line. You need to look at what you have coming in, after tax, then list everything you’re spending in an average month.

‘Once you’ve listed it all, it will be clear whether you can afford your lifestyle or if you need to make cutbacks.’

Sarah Coles, personal finance analyst at investment service Hargreaves Lansdown, adds: ‘The huge benefit of having everything written down like this is you can see where you’re spending money and not getting an enormous amount out of it, which will help you identify the best ways to cut costs.’

She says you will need to identify the bills you are overpaying for. And while there aren’t many cheap energy deals at the moment, you can still save on everything from car insurance to mobile contracts and broadband packages.

The money expert also suggests cancelling direct debits you don’t get enough out of — gym membership or subscriptions, for instance. And finally, avoid impulse purchases by waiting an hour or even a day before you buy something.

Shop cheap

Shoppers have been warned that food prices are going to rise thanks to the supply chain crisis.

Yet Andrew Hagger, expert at personal finance site Moneycomms, says thinking about what you spend at the supermarket can lead to big savings.

He says: ‘Food shopping is where a lot of money is wasted — use up stuff that’s in your cupboards and freezer.

‘Always plan your meals for the week, make a list and stick to it.’ He also suggests shopping at budget stores Aldi or Lidl.

Research by industry magazine The Grocer last month found Aldi to be the cheapest supermarket, with an average trolley of goods costing £45.12, compared to £51.32 at Asda and £70.18 at Waitrose.

Ms Coles adds: ‘We all swear by certain brands, but it’s worth downshifting at the supermarket to own-brands or budget alternatives to see if you notice the difference.

The most expensive brands will be at eye level, where you’re naturally drawn. Before you pick anything up, check the top and bottom shelf for a cheaper alternative.’

Meanwhile, Rebecca O’Connor, head of pensions and saving at Interactive Investor, says there’s money to be saved by bulk buying, explaining: ‘Always look for the cost per 100g or 1kg rather than offers like ‘three for two’.’

Sort Christmas now

There are fears that the supply backlog might mean we cannot get our hands on turkeys and Christmas presents later in the year.

However, there are still 11 weeks to go, so you have plenty of time to get everything in order for the big day.

Ms Suter says: ‘Try to work out how much you think Christmas will cost, then you can start setting aside a small amount each week to save for presents or food.

‘Hosting Christmas and buying all the food for family can feel a bit daunting. But you can make a list of non-perishable items and, starting now, add a few to your weekly shop in the run-up to the 25th to help spread the cost.’

Ms Coles says if you start shopping now, you can save on presents: ‘Take advantage of one‑day sales. Of course, this includes Black Friday, but if you want something from a specific store, it’s worth following them on social media and joining any clubs or newsletters they offer, so you’ll find out about their flash sales, too.’

She suggests using the CamelCamelCamel online price tracker which shows you historic deals on Amazon so you can see if you are getting a genuine bargain.

She also recommends using a cashback website such as TopCashback or Quidco to make extra money when shopping as normal, and also searching the internet for discount vouchers at that particular retailer.

Current offers include up to 14.45 per cent off at department store Harvey Nichols or up to 25 per cent off at Currys PC World.

Save your energy

The energy crisis means households can no longer save money by switching tariffs using a price comparison site.

So for now, the best way to save money on your bills is simply by using less energy.

Ms Coles suggests turning down the thermostat by one degree, not overfilling the kettle, turning appliances off rather than leaving them on standby, switching to energy-efficient LED bulbs and fitting draught-proofing to windows and doors.

By switching your thermostat off ten minutes earlier, you’ll save five hours of heating every month, or around £5, Mr Hagger says.

Ms O’Connor says her family have started batch-cooking for the week on a Sunday, when they make banana loaf cake for lunchboxes, stews and curries.

She says cooking like this will save energy on oven use if you use a microwave to reheat meals, and it will save costs on recipe book food which can involve expensive ingredients

She also recommends: ‘Some people who have traditional fires are bulk-buying wood for fires to avoid reliance on gas central heating.

‘This might be cost-effective if it means you are keeping the heating off in other rooms. Bleed your radiators and also switch them off in rooms you aren’t using and close the doors to keep heat in.’

Find a fuel fix

The petrol crisis has made some households think twice about their car use. And our experts say savings can quickly be made by easing off on the fuel you use.

Mr Hagger says: ‘Don’t use the car for non-essential short trips — consider walking or cycling as it is cheaper and better for your health.

If your car has an economy or efficiency drive mode then use it more. It may reduce the performance of your car but will lower your fuel costs.’

Sharing lifts to and from school or work also means you’ll save half the cost of petrol, says Ms O’Connor.

But it might be too soon to consider an electric car. Ms O’Connor says: ‘The surge in demand for electric vehicles may now be reflected in their price, so it might not be a cost-effective switch since the fuel crisis started. It may also be harder to get a good price for a petrol vehicle.’

Use spare time

If you cannot bear to make any more cutbacks, you could always bring in some more money.

Ms Suter says: ‘You could use your spare time to start a side hustle. Perhaps you have a hobby or skill that you could turn into a money-making plan, or you could take on an extra job in the evenings or weekends.

‘If that doesn’t appeal then use this as an opportunity to sort out your house and sell things you no longer need. There are lots of websites that make this process pretty easy, and it can help declutter and boost the coffers at the same time.’

Rachel Springall, from finance data analysts Moneyfacts, points out that you can earn free cash by switching bank accounts.

She says: ‘At the moment, HSBC will pay £110 cash plus provide a £30 Uber Eats voucher when bank customers switch to its Advance Bank Account, plus there is no monthly fee to pay.

‘While this is very tempting, it’s important that consumers look at all the features and charges to ensure it’s the right choice for their day-to-day banking needs.’

She also suggests using the Stocard smartphone app which stores all your loyalty cards in one place so you don’t miss any points or offers.

Plan ahead: Once you have your finances in better shape, it is time to think about creating a savings safety net in case you hit hard times

Get free help

There’s no shame in claiming every penny of support you are entitled to get from the Government.

Ms Suter says the charity Citizens Advice is a good place to start: ‘The benefits system is headachingly complicated to navigate, but there is lots of help you might not be accessing, like help paying energy bills in the winter or money towards childcare costs.’

Ms O’Connor adds: ‘If you are paying for childcare, are you always using the tax-free childcare scheme to pay for it?

‘Have you claimed relief for working from home during the pandemic in this year’s tax return? Are you eligible for any credits or allowances, such as Carer’s Allowance, that you aren’t claiming?’

You can find out about benefits you could receive at entitledto.co.uk.

The Government also last week announced a £500 million Household Support Fund for struggling families. The money will be available from this month in England through your local authority.

The Warm Home Discount Scheme also offers up to £140 off energy bills for struggling households.

Build a safety net

Once you have your finances in better shape, it is time to think about creating a savings safety net in case you hit hard times.

Ms Suter says: ‘If you know you’ll have spare cash each month then automatically transfer it into a savings account on payday to stop it being spent.

‘Setting a savings goal is always a good idea, whether it’s a specific amount of money or a particular thing you know you’ll need to pay for. Having a target in mind can help you get into the habit and stop you dipping into your savings pot.’

If you save routinely you can access some of the better interest rates in the savings market by opening a regular saver account.

The top rate is currently 3.5 per cent from Skipton Building Society — much better than the poor rates of as little as 0.01 per cent currently offered on easy-access accounts.

Ms Coles says if you’re lucky enough to get a pay rise, you could consider saving that before you get a chance to spend it.

She says you should also check the small print of your savings account, adding: ‘If you miss payments in some instances, your interest rate plummets.’

Ms Springall, from Moneyfacts, suggests using the auto-savings app Chip. She says: ‘Chip works out how much money users could save and sends a text message as a notification before transferring the cash to a separate pot.

‘Users can even see how long it would take them to save towards a certain goal, making it effortless to start building a savings fund.’