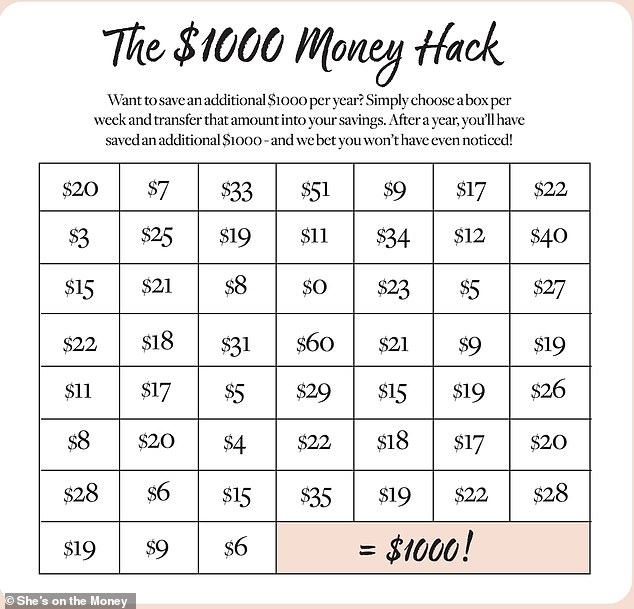

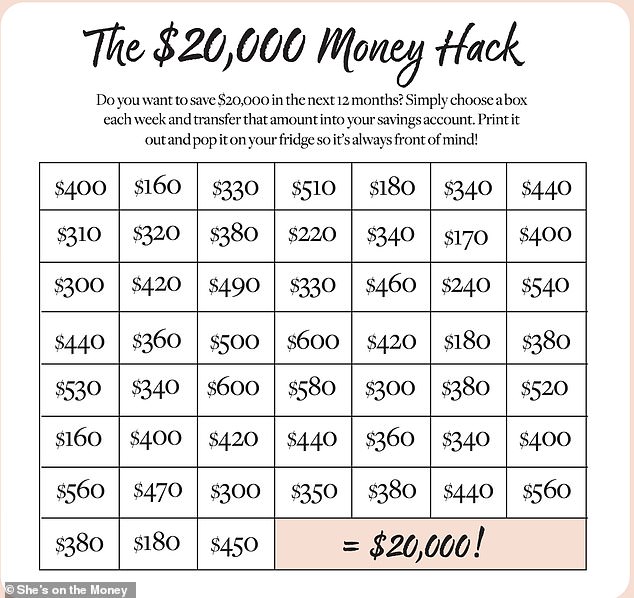

A free spreadsheet with 52 boxes filled with different sums of money is the key to saving between $1,000 to $20,000 in one year.

The money saving ‘hacks’ by finance platform ‘She’s on the Money’ offer four free spreadsheets online, and throughout 2021 many have found the tactics incredibly useful.

The strategy is simple – every week cross out a box and transfer the amount into your savings after getting paid and before spending any money.

The amounts in each box vary from $3 up to $600 depending on the end goal.

In the She’s on the Money Facebook group, hundreds of women rejoiced at how well the finance tips worked for them this year, and many were able to combine more than one spreadsheet together.

Hundreds of women are saving more money every year by tracking their expenses and using a free money sheet by finance program ‘She’s on the Money’ (stock image)

The strategy is simple – every week cross out a box and transfer the amount into your savings after getting paid and before spending any money ($1,000 money sheet pictured). The amounts in each box vary from $3 up to $600 depending on the end goal

Several women used the money sheets to pay off personal debt and save for car and home mortgage loans.

‘I did the $1,000 one and started it in Jan! It was so perfect as I used mine for Christmas! So much less stress, especially at this time of year,’ one woman wrote and asked how others went with the money hacks.

Another woman dubbed the $10,000 money sheet as ‘a blessing’ because she was able to save enough to buy a new car.

‘I’ll be doing the same next year but the $20,000 one to help me save for a house,’ the woman wrote.

‘I did the $5,000 savings plan and used to the money to pay an extra $5000 off a personal loan… It was the best feeling ever and such a great challenge to keep me focused!’ another said.

Hundreds online used the money sheets to pay off personal debt and save for car and home mortgage loans ($20,000 money sheet pictured)

Victoria Devine (pictured) is the founder and host of the ‘She’s on the Money’ podcast

It’s recommended to print off the money sheet and stick it on your fridge to keep track of the weeks easily.

Others said it’s important to transfer the money at the start of the month or straight after you get paid, rather than waiting until the end of the month or before you get paid.

In the comments, a financial advisor shared an important key tip for saving money moving forward.

Jasmine, from Melbourne, recommended writing down your entire budget for the year and include ‘hidden expenses’ that might come up.

‘Once I saw my incoming and outgoing, I decided to do a review of all expenses to try and reduce them,’ she wrote.

‘During Black Friday sales I managed to get cheaper car insurance and a better phone plan, I also cancelled a few subscriptions.’

Founder and host of the ‘She’s on the Money’ podcast, Victoria Devine, is on a mission to help millennials change their relationship with money by sharing clever ways to save, budget and invest.

The printable money saving sheets can be downloaded on the She’s on the Money website here.