A WOMAN has revealed how she paid off £42k worth of debt and was able to get a mortgage thanks to ten money saving tricks.

Amber, a mum of three who lives in Canada, shared the tips on her YouTube channel, The Fairly Local Family.

The mum said she and her husband had “paid off a large amount of student debt using these frugal habits, we have saved for a home with these frugal habits”.

And the couple use ten money saving habits daily to make sure they stay out of debt.

Amber’s first tip is to unsubscribe from store’s email newsletters, to stop the temptation of looking online, which inevitably ends up with items in your basket.

Instead, she said make a list of store’s and when their sale is and only check it at those times once you know exactly what you want to buy from there.

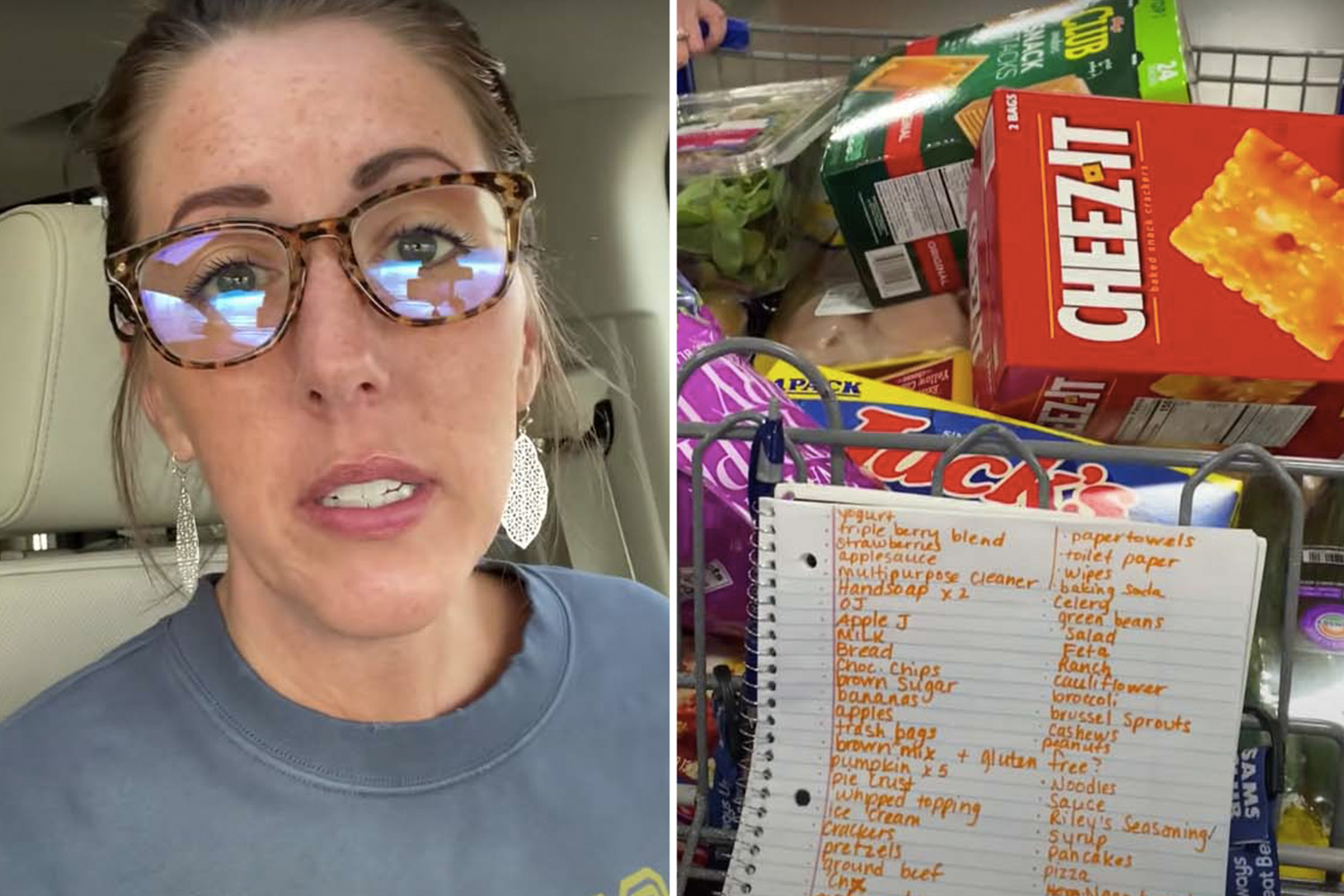

Amber’s next tip is super simple, she says don’t enter any shops without making a list of the items you need.

She said window shopping was a “gateway drug” to having a bunch of stuff in your basket you don’t need.

“I used to go window shopping all the time and tell myself I don’t need anything, I’m just going to look.

“What happens when you go look? You end up wanting things or you end up with stuff in your cart,” she adds.

Most read in Lifestyle

Scouring the clearance or discount items can also help you save more in the long run says Amber.

“I will go to the grocery store and look for 50% or 80% stickers on things and that’s the majority of the food I buy.”

She said she has saved so much more money since buying her groceries in the clearance aisle, and often freezes food to use at a later date.

Instead of going shopping, Amber will look around her home first, she said she often finds stuff she didn’t know she had which she can appreciate more or things she doesn’t need.

“You’ll go through your house and realise you have all this stuff you have, that you don’t want, then you can get rid of it.”

Amber either donates or sells the items, and she said it often makes it easier for her to keep her home clean and tidy.

She said selling those items helps the family keep their budget down as they can use the money to pay for their groceries.

FABULOUS BINGO: GET A £5 FREE BONUS WITH NO DEPOSIT REQUIRED

Second-hand shopping and thrifting is another way the family keep their living costs down so they can add more to their savings fund.

The mum explained: “I do this because when I shop second-hand I’m usually paying less than half the retail cost of it new.

“My kids wont wear something or outgrow it quickly, in which case I can resell it or donate it, and it’s not as shocking to my wallet.”

Growing food and foraging for it is another way Amber saves on cash, although she admits it may not be for everyone.

Amber also said to make sure you always ask for permission when foraging if it isn’t your property.

Another unconventional way Amber has saved money is by sharing skills with her neighbours.

As an example, she said if your neighbour is a plumber and you need your bathroom fixing, offer to exchange skills for free.

Amber also recommend lending and borrowing items with friends and family, rather than buying new products all the time.

The No Spend Challenge was another way Amber saved money, where for a set time she only spends money on necessities such as food and bills.

“We had $70k (Canadian dollar) debt, we cleared all our debt by using the No Spend Challenge,” she added.

Amber’s last tip is using the No Pantry Challenge, which means she tries to go a month without going to the grocery store by eating through her entire pantry.

“I hope you like these top ten tips I use these every single day to stay frugal, to keep us in a good state financially, I practice these all the time with my family.”