Jasmine Birtles will help with soaring costs

Growing up I was never taught, either at home or school, how to look after my money properly. We lived in Sussex and I can remember my father, a customs officer, warning me never to get into debt. But he never really explained why this would be such a bad idea or gave me advice on how to budget or save.

As I entered adulthood, meanwhile, the banks were doing all they could to encourage me to spend more than I could afford. This was the late-1990s and it felt like they were throwing free money at me, offering overdrafts and credit cards.

The mindset was very much ‘buy what you want first then pay for it later’ and I never even questioned it. I just happily took the money and thought it was the normal way to operate a bank account — to have a permanent overdraft.

I did manage to get myself on the property ladder by buying a house through a housing association shared-ownership scheme. It initially gave me a 40 per cent share of its value, and after a couple of years, I got a bigger mortgage to buy the rest.

But as a freelance journalist with an erratic income, I relied on credit cards for extra cash, running up debts of thousands of pounds doing up my first home.

I was also trying my hand as a stand-up comedian, though that was something I did more for enjoyment than financial gain.

The crunch finally came when I realised I could no longer meet the minimum payments on either of my two cards. I was now in my late-20s and my borrowing had reached a level so unmanageable that worrying about it kept me awake at night.

I’d been in denial for several months, barely glancing at my statements and simply hoping for the best whenever I went to withdraw money from the cash machine.

But the day came when I was unable to pay my bills — and that was when I finally faced up to the situation.

Whatever the money worries, I have ways to help you live cheaper and manage your finances

My stomach churning, I went to the cash machine and printed off the slip that would show just how deeply into my overdraft I was living.

Back home, I pulled out all the bank and credit card statements from the various drawers I’d stuffed them into and laid them out on the living room floor.

Looking at all this paperwork, noting how much interest I was paying on what I quickly discovered amounted to a good £10,000 of debt, was eye-opening.

I realised just what a killer compound interest is, the way it quickly piles up, making your debts spiral. And I could also see where my money had been going throughout the previous couple of years — frittered away on things like meals out, new clothes and soft furnishings.

In other words, nice things to do or have, but not worth losing sleep over if the only way you have to get them is on tick.

This lightbulb moment prompted two overriding emotions. One was sheer disbelief that a bright and well-educated Cambridge University graduate like me had such a woeful understanding of basic domestic finances — and that it had led me to this point in the first place.

The other was an absolute determination to get myself out of this mess as quickly as possible, because it dawned on me that the sooner I paid everything off, the less it would cost me in the end.

It was with this determination to see the situation I faced as a challenge, rather than an insurmountable problem, that meant not only did I manage to pay off my debts within a year (more of how I did this later), but I also soon started building up a healthy nest egg.

My success in doing that, and the fascination I quickly developed in all things money related, changed the course of my life.

Today, I am a financial journalist and self-taught money managing expert, the founder of Money Magpie — a self-help website that teaches ordinary people how to manage their money well.

On the site, myself and a team of financial experts educate others on how to make ends meet when times are tough — as they are for so many of us right now.

We also offer advice on how to get yourself out of debt as well as tips on how to come by the things you want and need in life as cheaply as possible, if not free.

I set up Money Magpie in 2008, after realising I was far from alone in having been woefully ignorant about how money works — after all, learning about compound interest, or how to invest in stocks and shares, has yet to appear on the school curriculum.

I felt certain that if I had been given even basic lessons in how to manage my finances I’d never have got into such a mess with money in the first place.

Following my own epiphany, it became my life’s mission to spread the word.

Right now, as we navigate a cost-of-living crisis that I believe is only going to worsen, sharing the tips and advice I’ve carefully tucked up my sleeve across more than two decades of financial study seems more important than ever.

That’s why I urge you to read my new series in the Daily Mail, launching today and continuing throughout next week, because it will be packed with enlightening money-saving tips and tricks that will help you get through these straitened times.

And next Saturday I will be joining the paper as a columnist, sharing my money-saving tips with you every week.

My hope is that you won’t just survive the difficult months — perhaps even years — that lie ahead. But that you might even find ways to come out the other side with your finances healthier than you could ever have imagined.

As I learnt first hand, it is possible to pay back debts in a relatively short time.

Key to my success, I believe, is that I was honest with myself, but also, crucially, with my family and friends about just what a pickle I’d got myself into.

The fact is, people often attach shame to being in debt, and so are reluctant to admit they have money problems to the people around them. But that only makes things harder.

I saw no reason to feel embarrassed for having got into difficulties in an area of my life that I’d never been taught how to manage. And so, if a friend asked me out to dinner, or suggested a weekend away, I simply explained that I was up to my eyes in debt and couldn’t afford it.

Sometimes, they’d offer to pay for me, which I’d accept on the understanding that I would return the favour once I had got myself straight.

Others would hear me out then realise they probably couldn’t afford to do it either. We’d meet up for a walk and chat instead, which did not cost a penny.

I’m certain that if I’d had to make up excuses for why I couldn’t go anywhere or do anything when there was a cost attached, I’d have buckled and done things I couldn’t afford. And that would have kept me in debt for far longer.

It’s why I strongly advise anyone currently trying to get to grips with their own debts to try hard to be similarly open about their struggles. As it was, throughout that year I spent nothing I didn’t have to.

For example, I was determined not to buy any new clothes. So I pulled out every white or lightly coloured cotton item of clothing I owned and used simple washing machine dye kits to give myself several new outfits.

![Right now, as we navigate a cost-of-living crisis that I believe is only going to worsen, sharing the tips and advice I've carefully tucked up my sleeve across more than two decades of financial study seems more important than ever. [File image]](http://homemoneysavingtips.com/wp-content/uploads/2022/05/money-saving-expert-jasmine-birtles-unveils-her-10-golden-rules-to-beat-the-cost-of-living-crunch-daily-mail-3.jpg)

Right now, as we navigate a cost-of-living crisis that I believe is only going to worsen, sharing the tips and advice I’ve carefully tucked up my sleeve across more than two decades of financial study seems more important than ever. [File image]

Cutting back and only spending money on essentials is important — it’s something many people are doing at the moment to help cope with rapidly escalating costs. But as we’re discovering during the current financial crisis, you can only cut back so far before you eventually hit a money-saving brick wall.

The game changer is finding ways to bring in some additional income too.

Back then, I tipped out the contents of my wardrobe and various cupboards and sold anything I couldn’t see a good use for on online marketplaces.

Books I’d never read again; CDs I didn’t listen to; unopened toiletries; shoes I’d worn just a couple of times — I sold them all. It didn’t matter how little I got for any of these. The point was that whatever money I made went towards paying off a debt that was accruing interest — in that situation, literally every penny counts.

Meanwhile, I earned money from babysitting, and signed up to various focus groups, which all paid cash.

I signed up to become a mystery shopper, which got me free bits and pieces plus a small fee on top. I even did some walk-on acting parts, which meant I was given free food on set, along with another small fee.

The few shares I had I sold. And the proceeds went straight towards paying off part of my credit card debts.

I used the Snowball Method. That’s when you throw everything you have at the debt which is charging the highest interest, until that debt has gone.

Then you move down through the debts that are charging less, until you finally hit zero.

By paying off your most costly debts first, you’re able to save on crippling compound interest — it’s a brilliant technique that I would strongly recommend to everyone.

Finally, after a year of living frugally and making extra cash wherever I could, apart from my mortgage, I was finally debt free.

I was elated, of course. But, crucially, this also provided another lightbulb moment.

Having spent a year paying hundreds of pounds a month off my debts, I realised that I could continue to manage my money carefully and invest a similar amount in building up a nest egg.

Throughout this series Jasmine Birtles is going to tell you all about her two-pronged approach to financial security, similar to that which turned her own situation around (stock image)

I began overpaying my mortgage, which reduced the interest I paid there. Doing that, plus putting in any chunks of extra money I earned for big work projects, took my balance to zero within nine years, my mortgage paid off.

I also began putting money into stocks and shares Isas, which I could see performed better than cash Isas. I then took out another mortgage, buying a larger property, a solid investment in itself. The biggest shock for me through all of this was how relatively simple achieving financial security was. That’s why I feel so passionately about helping people during these worrying times.

Throughout this series I’m going to tell you all about my two-pronged approach to financial security, similar to that which turned my situation around.

It consists of showing you how to save wherever you can — even getting some things free. I also hope to open your eyes to money-making opportunities to boost your income.

For example, I haven’t paid for a holiday — beyond flights — for years because I house-swap with people in France and America. It means I get to enjoy foreign holidays just for the cost of the travel. I save on flights, too, whenever I can.

Sometimes airlines make errors when posting flight prices online, putting a decimal point in the wrong place. This can, for a while, take a flight from £200 to £20, say. Did you know that there are websites that track these bargains down and then flag them up to people like you and me?

That’s the kind of secret that I’m going to let you in on this week. I will also share ways to reduce household bills, get cheap, even free days out with the children, while flagging up ways to make extra cash.

Whatever your money worries, I’m sure to have ways to help you live cheaper and manage your finances better. And it’s so much easier than you ever dared believe.

Jasmine Birtles: My 10 golden rules to get you going

- Live within your means and invest the rest. This is my secret to getting rich without really trying. It’s a simple formula: learn to get by on less than you earn and put away what is left over each month. It might mean that for a while you have to cut back on a few meals out and some other luxuries — but this is how you become wealthy!

- Pay yourself first. Set up standing orders from your bank account to savings and investments (maybe a pension and an Isa) — once you have done a bit of research by reading the articles in Money Mail or speaking to a financial adviser. Set the standing orders up to go out at the beginning of each month before you spend on anything else. At first it might seem like a stretch because you will have less spare cash, but after a couple of months you will get used to living on a smaller amount. Over time you will amass a surprisingly impressive amount of money without really noticing it.

- Share, share, share. There’s quite enough in the world for everyone to have what they need if we pool what we own. Do it in your own neighbourhood and circle of friends by lending power tools, giving food from your fridge to neighbours when you go away, babysitting among friends and neighbours and even making available (or renting out) your car when you’re not using it (just make sure your friend or neighbour is a named driver on your insurance). The more we share, the more we all get for free in terms of resources and services — and that saves money.

- Make the most of free stuff. Life is full of freebies. We just need to know where to look for them. For example, you can get free meals in restaurants by being a mystery diner and reviewing them for marketing firms. You can get free haircuts, beauty treatments and even dental work by students at local colleges and (almost) free holidays through house-swaps. On Tuesday I’ll give you 50 more ways to live for free. Look out for discounts, too, at vouchercodes.co.uk

- Compare and switch. When it comes to household bills, savings, mortgages and shopping generally, it really pays to compare prices, do a bit of research and see how much you can save. Once a year go on comparison sites such as comparethemarket.com (for insurance), moneyfacts.co.uk (for banking and savings) and broadbandgenie.co.uk (wifi and phonelines) to switch to cheaper versions. Multiply by 12 whatever you’ve saved each month by switching to see what you will be saving over the year. Give yourself a pat on the back for being so clever!

- Look for ways to make money on the side. You don’t have to be limited by your day job. There are hundreds of ways to make a little extra cash that not only help you to buy little luxuries but are often fun in themselves. For example, you could be a film extra and make about £100 a day for hanging out on a film set. And through dogwalking you could make about £15 per pet per hour.

- Think for yourself. Shops and businesses, both online and offline, are getting cleverer and cleverer at making us spend money on things that we don’t even want, let alone need. And this is why you must ensure you’re making your own decisions and not being mesmerised by clever marketing ploys into buying for the sake of it. Find tips on how to shop smart in my Saturday column over the next few months.

- Pick up some expert knowledge. It’s very helpful to have a good financial adviser to talk to about investments, tax and wealth-building. If you don’t have one already, ask your savvier friends and family for recommendations or go to vouchedfor.co.uk for a list of highly-rated advisers near you. But whether you have an expert on your side or not, it’s important to have basic knowledge about saving cash and investing. It’s honestly not that hard!

- Spread your bets. The best way to keep your money safe is to invest in a range of different products. Don’t put all your eggs in one basket. Instead, ‘spread your bets’ or, as the guys in the City say, ‘diversify your portfolio’. In other words, don’t put all your money in property or in savings accounts, spread it about in different products including shares, gold, pensions and more. This way, if one or two of these do badly, you have the others to fall back on.

- Keep calm and think long term. It’s easy to panic when markets are crashing and all the numbers are red. But if you can keep your cool in times of uncertainty and refuse to be spooked, you can often find opportunities to make money. Think long-term rather than being swayed or scared off by the ups and downs of markets and prices — and you are sure to see the wood for the trees. In fact, often the best time to invest is when an investment is at its most unpopular, when everyone else is selling. Be like multi-billionaire investor Warren Buffett who said, ‘Be fearful when others are greedy and greedy when others are fearful.’ Get free or cheap investment training at sites like eToro and The Motley Fool and my site, moneymagpie.com

EXCLUSIVE: Boris must get a grip on the cost of living crisis or LOSE the next election: New Mail poll reveals the toll of soaring prices on Britons… and delivers a stark warning to the PM

By John Stevens, Deputy Political Editor for the Daily Mail

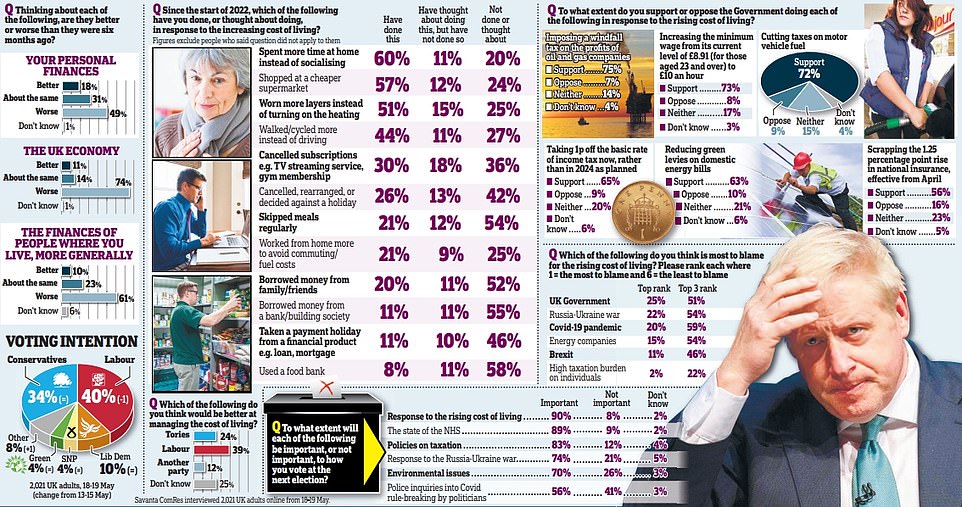

Boris Johnson must get a grip on the rising cost of living or he will lose the next election, a poll warns today.

Voters want immediate action to help struggling families, including bringing forward tax cuts.

The survey for the Daily Mail found there is also huge support for a windfall tax on the profits of big oil and gas firms.

Many people are already making changes to their daily lives to save money. Most have started shopping around for cheaper food, going out less and not putting on the heating as often, according to the poll. And an overwhelming nine in ten said the Government’s response to the cost of living crisis will be important to how they vote at the next election.

In a warning shot to the Prime Minister, the survey found that voters think Labour would be better at managing the crisis. In other findings:

- Three in four voters think the economy is in a weaker position now compared to six months ago, while half feel their personal finances have got worse;

- About two thirds (65 per cent) want the Chancellor to take 1p off the basic rate of income tax now, rather than wait until 2024 as planned;

- Six in ten say they have spent more time at home instead of socialising this year amid the cost of living squeeze;

- A half say they have worn more layers instead of turning on the heating, a fifth have skipped meals and 20 per cent say they have borrowed money from family or friends.

Mr Johnson yesterday vowed the Government would support the public through the cost of living crisis in the same way as it did through the coronavirus pandemic.

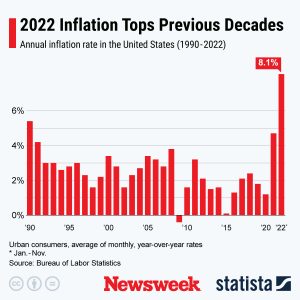

The Government is under growing pressure to act after it was announced this week that inflation had hit 9 per cent – the highest rate for 40 years. Pictured: Prime Minister Boris Johnson during a visit to Hilltop Honey in Powys, Wales, on Friday

The Prime Minister said: ‘Just as we got the most difficult challenges of Covid right, we got the big calls right, we will get this country through the big challenges now of the post-Covid aftershocks, the pressures caused in particular by the rise in the cost of living.

‘Of course we’re going to get through this and the markets will eventually adjust and new supply will come on and prices will come down again.

‘And in the months ahead, we are going to have to do what we did before… We are going to put our arms around the British people again, as we did during Covid.’

The Government is under growing pressure to act after it was announced this week that inflation had hit 9 per cent – the highest rate for 40 years.

The Bank of England’s chief economist warned that high inflation could last well into next year as disruption to energy and food supplies continue to push up prices. But there is widespread division among ministers on how to address the issue.

The poll, conducted by Savanta ComRes, found older people were more likely to say the economy has got weaker over the past six months, with 84 per cent of over-55s thinking it has, compared to 61 per cent of those aged 18 to 34.

Asked what changes they had made to their spending habits since the start of this year, 57 per cent said they had shopped at a cheaper supermarket.

Some 44 per cent have walked or cycled more instead of driving, and 26 per cent have changed holiday plans.

Downing Street will be concerned about figures showing that voters believe the Opposition would do a better job at handling the economic situation.

Asked which party would be best at managing the increasing cost of living, only a quarter (24 per cent) said the Conservatives, compared to 39 per cent who said Labour.

And just 53 per cent of those who voted Conservative at the last election said they believed the party would be better.

The Government’s response to the cost of living crisis was listed by 90 per cent of respondents as an important factor for how people will vote at the next election.

There is overwhelming support for a windfall tax on the profits of oil and gas firms to support families struggling with energy bills. Three in four (75 per cent) back the idea.

Labour support has dropped one point to 40 per cent compared to last weekend, while the Tories stayed on 34 per cent.

Chris Hopkins, of Savanta ComRes, said: ‘The rising cost of living could well become the defining issue of the next election.

‘While Partygate damaged the Prime Minister’s reputation and poll standings, he was always likely to have opportunities to redeem himself. Helping the country through rising bills and inflation is, in a way, an opportunity for the Prime Minister to do just that.’