University life need not mean subsisting on baked beans and living like a hermit. But with course fees alone of up to £9,000 a year, students need to budget.

Many will be paying for meals, housing, utility bills, books and travel for the first time.

As parents prepare to wave their children off to university, The Mail on Sunday asks current students to share their top money-saving tips.

New term: Freshers’ Week at University College London. For many students, it is the first time they have managed money

1. PLAN MEALS FOR THE WEEK AHEAD …AND STOCK UP IN ONE GO

Malcolm Marshall is studying law at Abertay University in Dundee. The 33- year-old student: ‘Plan meals for the week ahead and buy food in one go.

‘Cooking with your flatmates can be fun and home-cooking might even provide some healthier meals.’

Kayleigh Peplow-Woolf, studying finance at the London Institute of Banking and Finance, agrees.

The 20-year-old shops in the evening when food reaching its best before date is marked down. She adds: ‘Buying staples in bulk can also save money.’

2. FIND STUDENT DISCOUNT FOR EVERY PURCHASE

Rachael Gilbertson, 28, studying film and TV production at LMA University in Liverpool, says: ‘Get an NUS Student card, and sign up to the discount scheme TOTUM for savings at more than 300 retailers. Among the discounts offered is 10 per cent off at Co-op stores.’

She adds: ‘Other discounts can be found through the app Unidays.’

Leanne Forbes is studying midwifery at Robert Gordon University in Aberdeen. The 28-year-old says: ‘Always look to avoid paying full price.’

Websites such as MoneySavingExpert offer downloads of discount vouchers for a variety of different brands and stores. Others to consider include VoucherCodes and FreeStuff.

3. CUT TRAVEL COSTS WITH A STUDENT RAILCARD

Lili Teale is studying environmental science at the University of Portsmouth. The 20-year-old says: ‘Get a student rail card – it can pay for itself in one journey.’

A one-year card is £30 and enables those aged between 16 and 25 to enjoy a third off the price of off-peak travel.

Comparing the cost of different utilities suppliers can help students keep their bills down

4. SHOP AROUND TO CUT COST OF UTILITY BILLS

Ton Floodgate, who is studying for an MA in Modern History at the University of East Anglia, warns students not to pay over the odds for electricity, gas and broadband when they move out of halls and into private accommodation.

Comparison websites such as Uswitch and GoCompare might save you an average of more than £200 a year by finding a cheaper energy supplier.

The 22-year-old adds: ‘Many students use apps that help split household bills.’

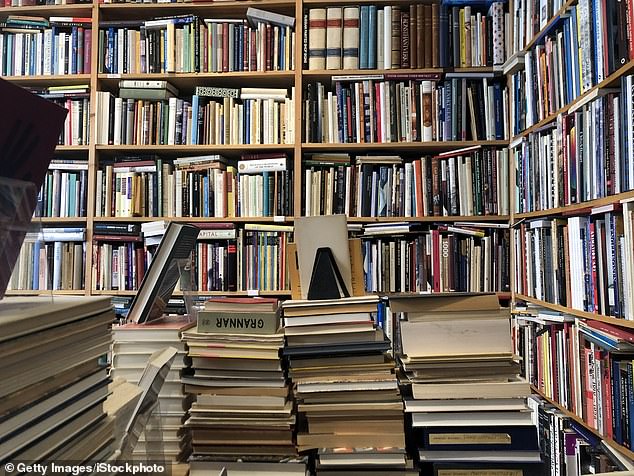

5. BROWSE FOR BOOKS IN SECOND-HAND SHOPS

Ram Adrian is studying law at University College London. The 31- year-old advises students not to rush out and buy all the books on their reading list.

He says: ‘Many books can be read online and might be available to download for free. If you want a physical copy, consider buying books second-hand.’

The library may also stock copies. Ram adds: ‘It might also be worth approaching your lecturer and being honest about your financial constraints, and asking which books they think really are essential.’

Yazmin Bleakley, who is studying international politics and conflict studies at Queen’s University in Belfast, came up with another idea to save money on books.

The 20-year-old has set up an Instagram account @readby.yaz reviewing books and gets sent free copies by publishers.

Balancing the books: Second-hand textbooks can be much cheaper than brand-new versions – or they might even be available to download online for free

6. ACT EARLY TO BOOK YOUR ACCOMMODATION

Bella Pearce is in her second year of law at Nottingham University. The 20-year-old says: ‘Start to look for somewhere to live early on when the best and most affordable houses are still available.’

If renting privately, try to haggle on price – and see if you can get a shorter or discounted contract where you pay less in the summer months.

7. FIND A PART-TIME JOB… AT YOUR UNIVERSITY

If you have the time, Dolly Carter, 20, who is at the University of East Anglia studying English literature with creative writing, recommends finding a part-time job.

She says: ‘You can often find work within the university or the student union before you even move into halls.’

Dolly adds: ‘You may not be desperate for the money, but it enhances your CV and means you can build a little extra into your budget for societies, sports clubs and nights out.’

Students should insure gadgets such as laptops to avoid unexpected replacement costs

8. BUDGET YOUR LOAN ACROSS THE WHOLE YEAR

Stay on track with student loan payments, says Dolly Carter. ‘Take note of the dates that each of the three instalments are due to be paid into your bank account.

And be wary of being caught short with the last payment – as although it may be more than the first two, it must last across the summer.’

9. PICK A BANK… AND COMPARE THE FREEBIES

High street banks are keen to attract students – hoping that once lured in, they have a customer for life.

As an enticement they often throw in freebies. Santander 123 offers a four-year 16-25 railcard as a sweetener. It also has a £1,500 interest-free overdraft facility.

For a more generous £3,000 interest-free overdraft Nationwide Building Society and HSBC are considerations.

HSBC also includes an £80 handout and a £20 voucher for online food service Uber Eats.

10. MAKE SURE THOSE GADGETS ARE INSURED

Laptops and mobile phones are expensive to replace, so it is worth insuring them against loss, theft or damage.

Parents may be able to cover these items in their own home insurance policy.

Sometimes cover is included, otherwise it is usually offered as an add-on that could be cheaper to buy than an additional standalone policy.