What’s your number one tip for saving money on a tight budget? We put the question to our savvy Facebook and Twitter community.

The results were a cornucopia of money-saving methods, from small shopping tweaks to full financial systems. Some were learned through experience, while others were passed down from generation to generation.

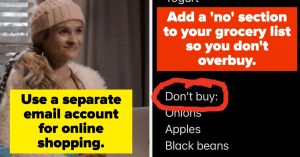

Here, we round up 15 of the best tips for spending less from our friends online.

1. Don’t buy what you can’t afford

Spending beyond your means can be the first step towards financial trouble. Simply buying only what you can already afford is one way to avoid falling into a debt trap.

Following this rule will help you to swerve ‘buy now, pay later’ schemes, which, according to our research, encourage overspending in a quarter of people who use them.

2. Check the ‘reduced’ aisle in supermarkets

When you supermarket shop by pass the general shelves & head straight to the reduced to clear shelves & you’ll be surprised what you can buy for cheap.

— Errol lynne (@PlawJackie) March 27, 2021

You’ll have seen supermarket ‘reduced’ aisles and items on your shopping trips. These are items, often adorned with yellow stickers, that have been discounted due to imminent use-by dates.

If you don’t regularly pick things up from here, this tip could definitely save you a bit of cash. Just make sure you only buy products that you know you will eat soon, or that you can freeze to eat later.

3. Pay in cash to stick to your budget

3. Pay in cash to stick to your budget

We’ve said it before and we’ll say it again, cash can be a great budgeting tool. Millions of people in the country rely on cash every day, often to help control spending, so it was no surprise to read multiple comments suggesting this tip.

Cash helps you save by physically limiting the means you have to pay while you’re out. If you bring £20 with you (and no cards), that’s all you’ll spend by necessity. Many of you said this was a helpful spending hack.

Sadly, cash is threatened at the moment, by bank branch closures and shops adopting card-only policies during the pandemic. Which? is campaigning to protect it for everyone who needs it.

4. Avoid spending on takeaways

Never buy home-delivered take-away food. Always cook for yourself with ingredients bought from the supermarket.

— Bill Blackley (@Bill_Blackley) March 27, 2021

The takeaway market has boomed during the pandemic, with firms such as Just Eat and Deliveroo making it easier to get restaurant food to your door.

But steering clear of takeaway meals and sticking to home cooking will very likely save you money.

But you don’t have to sacrifice flavour. You can serve up ‘fake-aways’ that are just as tasty. Use our tips for creating an authentic Chinese meal at home.

5. Cook from scratch and avoid waste

We read many comments about cooking from scratch and avoiding waste.

Bulk buying essentials that don’t spoil, batch cooking and freezing leftovers were all suggested.

As was keeping a meal plan that you stick to throughout the week, so you only buy exactly what you need when you’re in the supermarket.

With lockdown making it harder to get to supermarkets and many wanting to keep online delivery slots free for those in need, some have been turning to meal subscription services such as Hello Fresh and Gousto to help cut down on waste.

6. Mend and make do

6. Mend and make do

One commenter told us she hadn’t bought new clothes in years. Instead, she has learned to mend or adjust the clothes she already owns.

As shops reopen across the country after lockdown, it might be tempting to splurge on some new clothes.

But you might be able to save by re-dying some old jeans or customising a shirt or t-shirt.

7. Separate ‘want’ and ‘need’

‘I keep a budget book. If I need something I save for it. By the time I have saved for it, the original item is either on sale (so cheaper) or I find I don’t need it and have some savings.’

– Bla via Facebook

A number of you said the distinction between what you want and what you need was very important to saving money.

It’s okay to buy the things you need, but when it comes to things that you only want, it’s best to save up, or to wait and see if it gets cheaper, or if you still want it in the future.

8. Keep a ‘Jolly Pot’ for treats

8. Keep a ‘Jolly Pot’ for treats

Bla from Facebook also mentioned what they call their ‘Jolly Pot’, which they fill up with spare change. Whenever it’s full, they spend the contents on treats instead of essentials. Not a bad way to reward yourself for saving.

If you don’t use cash regularly some banks such as Monzo, Lloyds Bank, TSB and Halifax allow you to do this with your debit card payments. They work by rounding up what you spend and moving it to a pot or savings account linked to your account.

9. Don’t shop on an empty stomach

We had a few comments suggesting shopping while hungry is a recipe for disaster.

Studies have shown that purchasing when peckish does lead you to spend more, even when you’re buying items that aren’t food. Best have a bite to eat before you next hit the high street.

10. Buy own-brand

This is especially true in Aldi and Lidl. So many of their biscuits and chocolate bars are way better than the ‘real’ brands. Give me a Jive over a Twix any day of the week.

— mark gibson (@Markgibson2018) March 27, 2021

Buying own-brand goods is a known way to spend less. But some of you went further and said they can actually be better.

Keep in mind that it varies between supermarkets exactly how cheap own-brand products are. Own-label large free-range eggs in Waitrose, for example, were £1.15 more expensive than those from Lidl in March 2021.

11. Shop at a cheaper supermarket

Many commenters’ number one money-saving tip was simply to shop at Aldi or Lidl. Frankly, we’d have to agree that this would save you money, at least if you’re buying the popular branded and own-label products in the basket we use here at Which? for price analysis.

Earlier this year we crowned Lidl the cheapest supermarket of 2020, with Aldi coming second by a mere 34p. The next closest rival, Asda, was more than £5 more expensive.

12. Resist ‘special offers’

Everyone loves a bargain, but sometimes ‘special offers’ aren’t that special at all.

Take Black Friday, for instance. For multiple years, Which? research has revealed that products sold at ‘special’ Black Friday prices often end up selling at the same price or cheaper later in the year. Some had even seen the same reduction in the months before November.

It’s not just big-ticket items that suffer from this. Supermarkets often reduce the same grocery items several times a year, meaning a discount one day could come around again soon.

All this means you should think carefully before you pounce on a price drop.

13. Empty your cupboards

Try and make use of what you have already got,during lockdown we have made use of products sitting in cupboards rather than spending more

— kellie (@fredntwister11) March 27, 2021

We’ve all got a few tins of beans gathering dust in the back of the kitchen cupboard. Before you shell out for new groceries, have a think about what you can do with the ingredients you already have. Beans on toast, anyone?

14. Bring food when you go out

We all know eating out costs more than eating in. So if you’re on a day out somewhere you know the food and drink will cost more, prepare your own at home and bring that instead.

Pubs and restaurants may be reopening in some parts of the country, but that doesn’t mean you can’t enjoy a picnic.

15. Stay on top of your accounts

‘Use an accounts book! Plan what comes out each month at the back and mark everything in at the front which goes in and out. Save in a savings account at the start of each month and use a credit card but only as much as you can afford to pay back without interest! My mum taught me well! I can go back 37 years with those accounts!’

– Johan via Facebook

Johan’s tip, passed down by his mother, encompasses a lot of things. There’s the monthly savings, the targeted and sensible credit card use, and of course the accurate and up-to-date accounts book.

Underpinning all of this is the principle of managing your finances carefully and having every penny accounted for. We’re very grateful to be able to pass Johan’s mother’s tips on for more people to follow.